Coronavirus is in the news. It is likely to stay in the news for some time.

Here are 20 thinks to know – or consider – surrounding coronavirus and business contingency planning.

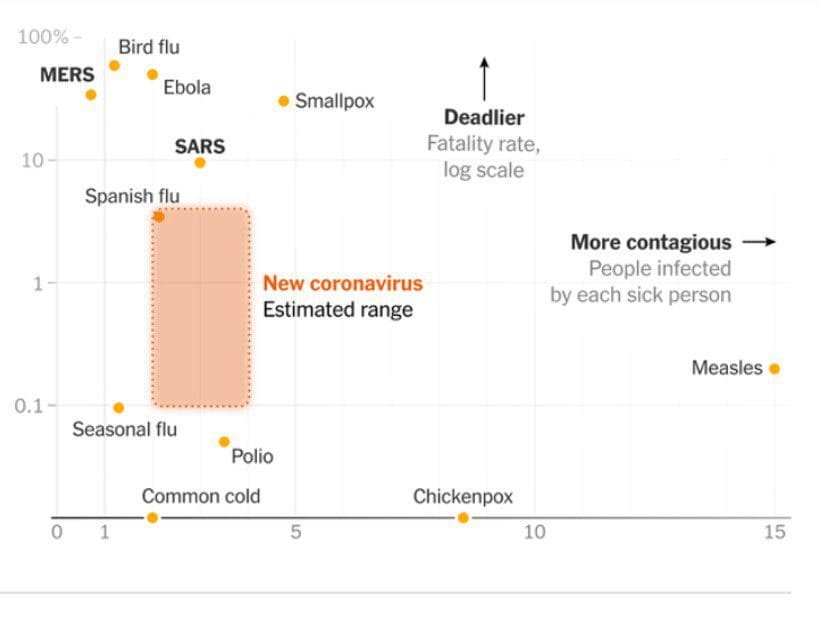

- The raw math of how bad this crisis could be is alarming. For the flu, every person that gets the virus infects on average about 1.3 other people. For coronavirus it is 2.2. The death rate for the flu is one tenth of one percent. For coronavirus it is said to be 1.5 to 2.0 percent. The percentage of people that need hospitalizations is most alarming. One report says it is 25 percent.

- The infectability rate is not a constant, or a rate of greater than 1 would mean everyone in the world would catch the disease. For the flu, good weather brings a drop in the rate. For the more serious coronavirus, quarantines are the main tool used by health authorities lower the infection rate.

- Further, these percentages are almost certainly too high because there are people that caught the virus that did not become sick enough to seek help. These people do not get counted as having the illness. In short, a range of models makes the disease look both deadlier and more infectious that the Spanish Flu to something that is not too much worse than the seasonal flu. But good contingency planning works off of worst-case scenarios.

- China, while they were too slow to acknowledge and attack the heath crisis, applied quarantines with draconian efficiency once they got organized. That has worked. The virus is abating in China. It is doubtful, however, that democracies can apply the quarantines with the same level of brutal efficiency.

- The disease can NOT be stopped at the border. People can have the virus and not show symptoms for several days. It is a very mobile world.

- Many companies have contingency plans around facilities going down. These contingency plans remain largely the same whether a plant goes down because of an earthquake, tornado, or in this case, a quarantine. There plans designate selected employees to do a long list of activities such as figure out how to serve existing customers from other sources of supply, plan for overtime at other plants, call workers and let them know their new schedule, etc. These plans are often hundreds of pages long.

- It is time for companies to run drills around these contingency plans and make sure that everyone knows what they need to do and that they can do what they are tasked with doing.

- The good news is that the World Health Organization is saying the quarantine period for those infected or potentially infected is 14 days. A plant damaged by a fire could be out of commission for months.

- The bad news is that companies should not assume it is just going to be one facility affected. It could be that one week a plant in Texas is affected, three weeks later a distribution center in Amsterdam, and the week after that the entire port of Vancouver might be closed. Much greater agility may be needed. Quick response and reaction teams may need to be augmented.

- I am beginning to hear that some companies are very busy with these activities and are cancelling trips to some of the spring supply chain conferences. The cancellations are more prevalent if international travel is required.

- Because of the huge impacts of this disease in China, and because China is the largest manufacturing nation in the world, Western companies reliant on inbound raw materials and components have already been affected. The High Tech, Automotive, and Pharmaceutical industries have been greatly affected.

- From a national security perspective, it is unfortunate that such a high percentage of active pharmaceutical ingredients are produced in China.

- The quicker a company has visibility to supply disruptions, the quicker they can work to resolve the issue. Further, in some scenarios, knowing before your competitors can lead a competitive advantage. For example, if a key supplier to an industry is affected by the outbreak, the company that knows first can work to lock up alternative sources of supply that may become unavailable to their competitors. Suppliers like Resilinc, RiskMethods, and others as well, provide real-time risk data.

- New supply chain plans will need to be created. Supply chain planning vendors such as Kinaxis, Solvoyo, Blue Yonder, and OMP provide planning solutions with concurrent planning. Concurrent planning links new contingency plans necessitated by the disruption to the sales & operational plan (S&OP). As new short-term scenarios and plans are created, the linkage to the revenue and profitability goals based on the initial S&OP plan becomes instantly visible.

- On the outbound side, suppliers like FourKites can provide real-time estimated time of arrival shipment data that can lead to more accurate delivery expectations being set for anxious customers.

- If one assumes that one facility might be quarantined one week, another a few weeks later, and so forth, transportation network design solutions from companies like LLamasoft, Oracle, and Blue Yonder can be used to cost effectively improve agility. These solutions can be used to run continuous what-if analysis of potential new flow paths to deal with the new disruptions and constraints. The solutions also understand the additional costs that will be incurred surrounding the proposed flow paths.

- When it comes to protecting customer service levels, inventory buffers are a great risk mitigator.

- Companies may choose not to stuff their warehouses with inventory, however, because there are a growing number of financial authorities that believe the coronavirus will lead regional or global recessions. Some financial analysts argue the stock sell offs mean that the stock market has already factored the belief that a recession will occur into the stock prices.

- Demand planning breaks down during recessions. One of the worst things a company can do when the world is tipping into a recession is to react too slowly. Demand planners are, not surprisingly, much better at forecasting in a steady state environment when things are not changing too much.

- Companies that forecast more often, and who use actual consumption data at the point of purchase in their forecasting engine, will react more quickly and carry less inventory, than companies using order and sales history who only do monthly forecasts.