Ten years ago, an ARC Advisory Group colleague described the China residential telecommunications landscape to me as one that advanced from traditional in-person communication (think Rocky Balboa saying “I’ll just call you…I’ll go ‘Hey yo!’”) directly to cellular networks – virtually skipping the entire 20th century paradigm of landline telephone communications. Of course, this was an exaggeration, but it illustrated his point well. “You don’t see suburban roads lined with telephone polls and wires strung between them like you do in the US,” he explained. And for good reason. It doesn’t make sense to network a community in that way if you were to start from scratch today. Cellular networks are much more practical and offer much greater flexibility to the end user. Of course, fiber optic land lines offer greater bandwidth. But bandwidth is one dimension. Sufficient bandwidth can often be obtained from cellular networks without the intrusive, omnipresent infrastructure of above-ground landline networks. I see a similar paradigm playing out in the warehouse automation landscape of China. Traditional “bolted-down” automation is the landlines in this paradigm. Sure, it may have higher throughput (bandwidth) than warehouse robotics, but robotics offers benefits in other forms – greater flexibility and faster time-to-value.

Ten years ago, an ARC Advisory Group colleague described the China residential telecommunications landscape to me as one that advanced from traditional in-person communication (think Rocky Balboa saying “I’ll just call you…I’ll go ‘Hey yo!’”) directly to cellular networks – virtually skipping the entire 20th century paradigm of landline telephone communications. Of course, this was an exaggeration, but it illustrated his point well. “You don’t see suburban roads lined with telephone polls and wires strung between them like you do in the US,” he explained. And for good reason. It doesn’t make sense to network a community in that way if you were to start from scratch today. Cellular networks are much more practical and offer much greater flexibility to the end user. Of course, fiber optic land lines offer greater bandwidth. But bandwidth is one dimension. Sufficient bandwidth can often be obtained from cellular networks without the intrusive, omnipresent infrastructure of above-ground landline networks. I see a similar paradigm playing out in the warehouse automation landscape of China. Traditional “bolted-down” automation is the landlines in this paradigm. Sure, it may have higher throughput (bandwidth) than warehouse robotics, but robotics offers benefits in other forms – greater flexibility and faster time-to-value.

Robotics Adoption, ROI, and the Status Quo

My colleague Fox Chen and I are a month into ARC Advisory Group’s research update on the mobile warehouse robotics market. The data is just beginning to form a picture and the details of that picture are sure to change as we progress. However, at this point it appears that mobile warehouse robotics adoption has accelerated rapidly in China. This is surprising because logistics technology adoption has historically occurred initially in North America and Western Europe, and then other economies adopt the technology after a substantial time lag.

I attribute the rapid adoption of mobile warehouse robotics in China to three factors:

-

- Global rapid technology diffusion

- China’s explicit emphasis on digitization (see 14th Five-Year Plan)

- ROI and the Status Quo

Rapid Technology Diffusion

As a general rule, technology diffusion in both product development and adoption is extremely rapid and widespread. In today’s world, information is disseminated faster than ever, and the trade of physical goods is extremely widespread as well. However, I believe that the rapid exchange of information has allowed companies to innovate and replicate at a much faster pace than in the recent past. This is particularly true for mechatronics that can be reverse engineered more readily than software code. Many executives of warehouse robotics companies to whom I have spoken inform me that they view the software intelligence of their robotics systems as the true strategic differentiators in their offerings.

China’s Five-Year Plan and Digitization

China as a country has chosen digitization as a core tenet of the country’s Five-Year Plan. And digitization projects with the manufacturing sector are a part of that tenet. Although I do not have formal confirmation, I believe that warehouse robotics may be an area where China’s government is supporting research and development efforts to accelerate the country’s competitiveness. Government subsidies would certainly support domestic development of warehouse robotics. However, China is also transitioning from an export country to a more balanced economy with increasing levels of domestic consumption. Most examples of warehouse robotics adoption in China are at operations in support of domestic consumption and these examples are predominantly consumer goods retail fulfillment operations.

Retail Fulfillment, ROI, and the Status Quo

Retailers, producers and distributors of consumer goods, and logistics service providers supporting retail clients are the three industries in China that appear to be adopting warehouse robotics most rapidly. Furthermore, most of this is adoption of robotics from domestic Chinese providers. I believe that Chinese retail and fulfillment operations are adopting mobile warehouse robotics so rapidly because of the paradigm that was also present in communications networks a decade ago – growth in demand driving a need for a technology solution in a landscape without widespread legacy automation in place. There are limited situations where existing automation can receive incremental updates that provide substantial benefits.

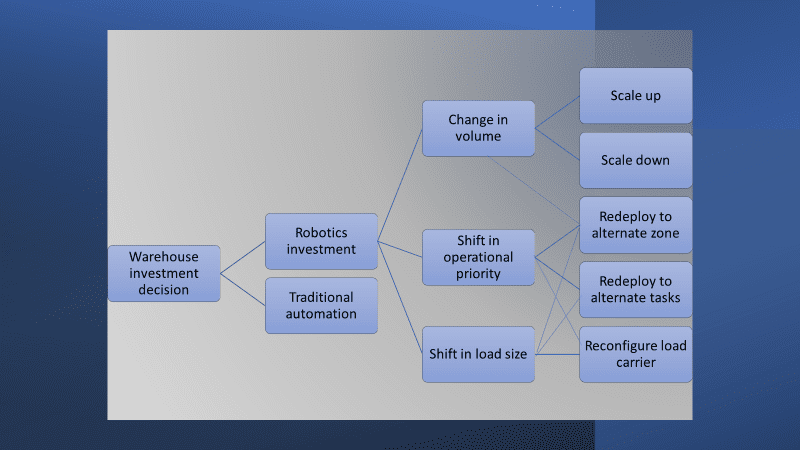

These warehouse operations are looking for substantial performance improvements over the status quo. And warehouse robotics offer throughput increases with lower capital costs, quicker time to value, and greater flexibility than many traditional forms of automation. The return on investment (ROI) decision is substantially different in these situations than it is in operations with existing bolted-down automation.

Mobile Warehouse Robotics Market Implications

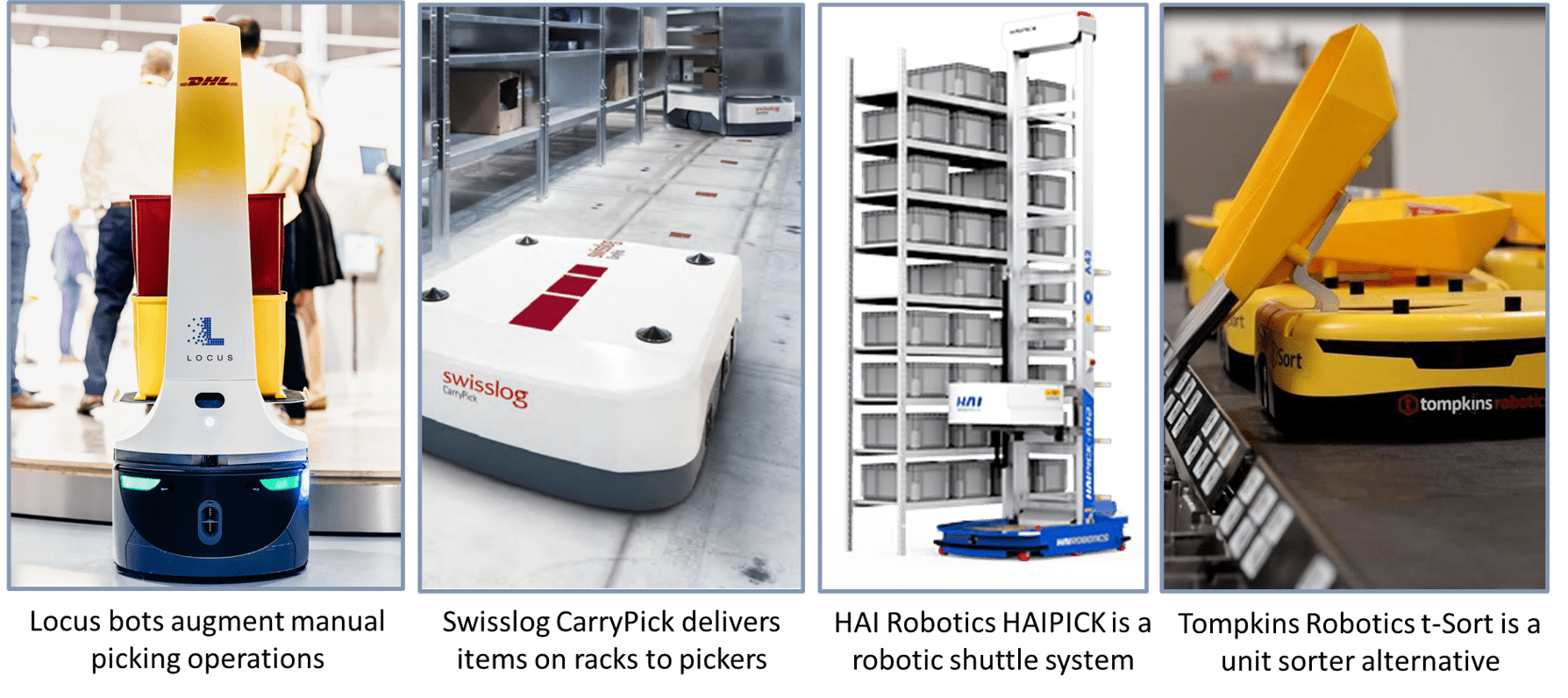

There are many implications of the rise in mobile warehouse robotics development and adoption in China. For potential customers of robotics, China-based providers may offer a solution that is a good fit for your requirements. For mobile warehouse providers, the total addressable market in China may be much larger than I (and possibly you) would have anticipated. For me, this is due to the fact that I did not previously consider the impact of legacy automation installations (and the lack thereof in China) and the impact this factor has on the decision-making process and the benefit to mobile warehouse robotics adoption. Furthermore, the rapid increase in autonomous case handling robots (HAI Robotics and others) is serving as a substitute for warehouse operations in search of storage density and case handling automation, addressing an addition segment of the market.