An interesting and useful exercise for logistics executives to do at their annual strategic planning meeting is to ask, What are the megatrends that will change the face of logistics in five years? Ten years? Twenty years? And even forty years?

For me, the three biggest megatrends are robotics in logistics (both for the warehouse as well as driverless cars/trucks, and maybe even drones), omni-channel fulfillment, and the need to develop new distribution models to address the bottom of the economic pyramid.

We have written a fair bit about the first two trends, but not so much about the third trend – “consumers” at the bottom of the economic pyramid. Florian Güldner at ARC wrote a strategic report called “The Structure of Manufacturing in 2050” (available to ARC clients only) that provides some good coverage of the third megatrend. Here’s an excerpt:

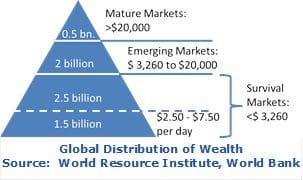

“Economists typically use a pyramid to represent the global distribution of wealth. The ‘bottom of the pyramid’ refers to the four billion poorest people in the world, in particular the segment of around 1.5 billion people living on from $2.50 to $7.50 per day. While much attention has been paid to the growing middle class in emerging economies, business with the lowest income class has been neglected for a long time.”

Many Western multinational firms understand that growth will largely come from developing countries. Procter & Gamble, for example, has a goal to acquire 1 billion new customers. This goal is not reachable by just focusing on an emerging middle class. Unilever seeks to sell Lifebuoy soap by educating 1 billion poor Asians and Africans about the health benefits of handwashing.

The logistics challenges include the need to deliver goods packaged in small handling units to a large number of extremely small footprint store fronts; making deliveries in both crowded, congestion-choked metropolises as well as remote villages; and terrible infrastructure. The size of the goods delivered can range from very small – “Danone sells a small, 50-gram pouch of drinkable yogurt in Senegal that doesn’t require refrigeration for roughly 10 cents” — to low cost bulk goods like bags of rice.

Local sourcing can also help consumer goods companies be perceived as good corporate citizens while improving the buying power of small farmers. But the farm-to-fork supply chain is blemished by very high spoilage.

And when you deal with small, unsophisticated retail outlets, engaging in a robust forecasting process is difficult, although this problem is not insurmountable (see “How a Large CPG Company Runs an Efficient Supply Chain in Developing Countries”).

The cool chain, transporting temperature-sensitive food products, is obviously more challenging. Further, the need for developing a cool chain for the developing world is increasing because of new innovations allowing storefronts to carry more of these products. “A craftsman in Gujarat, India created a $40 terracotta refrigerator using the natural cooling of clay to work without electricity. It can store water, fruits, and vegetables for eight days and milk for one day.”

For large multinationals, this is the last untapped market that can help to drive robust growth. The easy route would be to hand the job over to distributors. But distributors often won’t have an interest in supplying the goods of just one manufacturer. For large multinationals, the challenge is to accept the job of distributing to very small retailers, or alternatively, to use their supply chain expertise as an additional value add that will make the distributors view the manufacturer as a preferred partner.