McKinsey, the global consulting firm, has done research and writing on supply chain collaboration. In some industries, suppliers account for over 80 percent of the value of the products that are produced. In one McKinsey survey of more than 100 large organizations in multiple sectors, companies that regularly collaborated with suppliers demonstrated higher growth, lower operating costs, and greater profitability than their industry peers. Companies with close collaboration with suppliers outperform their peers. Depending on the industry, companies can see cost savings of 5 to 10% and revenue gains of 7 to 10%.

But the vision of a truly integrated supply chain, McKinsey says, has proven difficult to realize. Companies “seeking to increase data sharing and collaboration across their supply networks have faced three principal hurdles.” Those include trust issues, the operating model, and technology. The remainder of this article will focus on the technology issues.

Supply Chain Collaboration Networks are a Key Technology

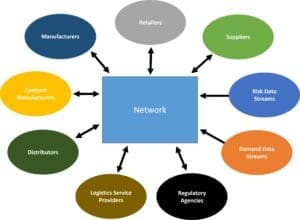

A Supply chain collaboration networks (SCCN) is a key technology for improved collaboration across an extended supply chain. A SCCN is a collaborative solution for supply chain processes built on a public cloud – many-to-many architecture – which supports a community of trading partners and third-party data feeds. SCCN solutions provide supply chain visibility and analytics across an extended supply chain.

Networks have distinctive advantages when it comes to supplier onboarding and communication management, partner management, accessing critical third-party data, being able to provide unique analytics, and in providing a collaborative system of record. The larger the number of industry participants on a network, the better the solution is at sourcing and onboarding. The LevaData solution, for example, speeds up sourcing significantly. But this is particularly in the electronics industry, where the majority of their customers hail from.

A variety of distinct solutions can generate these network-driven collaboration benefits. They include EDI Value Added Networks, solutions that originally arose to support industry specific procurement in a marketplace environment, transportation management or other forms of collaborative supply chain applications based upon a public cloud architecture, real-time transportation visibility solutions, and interesting new solutions that can identify supply chain risks in near real-time. Cumulatively, these distinct solutions make up the SCCN solution set.

20 Things to Know About SCCN

When it comes to this technology and collaboration, there are several things worth knowing based on ARC’s market research on the supply chain collaboration network market. During this research, ARC talked to executives at many suppliers – both big and small – serving this market. We also interviewed end users.

- Collaboration through a SCCN can be based on the exchange of messages or a collaborative network application. The difference between messaging and a collaborative application, is that the collaborative application allows the information exchanged to be acted on. For example, transportation management solutions from Blume Global, Descartes, E2open, One Network, and others, allow tenders and tender-accepts to be automated in a holistic application that manages the end-to-end transportation process.

- The messages (or collaborative applications) span across Plan, Source, Make, Deliver, Returns/Recalls, and Supply Chain Finance (factoring).

- No single SCCN can meet all a company’s collaboration needs because no SCCN supplier does a good job across all these message types.

- The most common message types exchanged are Source – particularly purchase order (PO) and purchase order confirmation messages – and Deliver – messages surrounding when goods are likely to arrive. These are often EDI messages.

- Some of the largest suppliers in the market – IBM, Descartes, OpenText, and SPS Commerce – have EDI value added networks (VANs). EDI VANs were the first form of SCCN messaging that evolved.

- Some view EDI messages as being inferior because they are not real-time messages. But what is important is not that messaging is real-time, but that the messages occur in right time. PO accepts, for example, are not real-time messages because a supplier needs time to figure out whether they can deliver the number of items requested by the requested delivery date.

- There are messages that need to be real-time. Blume Global, Descartes, FarEye, FourKites, and others have developed solutions that allows companies to see where inbound or outbound goods are in real-time. The sooner a company knows a planned delivery is apt to be late, the more options there are to cost optimally mitigate the situation.

- Transportation visibility solutions provide a good example of the distinct advantages of network-based analytics. A vast amount of network data can be analyzed to generate predictive estimated time of arrivals (ETAs) based on machine learning. A company trying to do this with an internal data set would not have enough data to generate meaningful predictive ETAs.

- Certain types of risk messages also need to be real-time. Notice that a port is closing, or a key supplier is going out of business, do need to be real-time. The quicker a company finds things out the better they can mitigate the situation. Interesting network-based solution from resilinc and RiskMethods comb hundreds of thousand online news and social media sites to generate these types of alerts.

- Certain message types are still uncommon. SC Finance and Make fall into this category.

- In SC Finance, a bank is given visibility through the network that goods have shipped from a seller (the supplier) to a manufacturing customer. Small suppliers often sell their accounts receivable at a discount to secure cash flow. But based on the assurance the transaction is genuine, banks can offer a better deal to the suppliers. OpenText is one of the few SCCN suppliers that offers this kind of solution.

- Make messages are also relatively uncommon. Make messages allow a company to monitor the quality of goods produced by a contract manufacturer or key suppliers. E2open, Infor Nexus, SupplyOn, and TraceLink provide this kind of messaging.

- The SCCN market is growing quickly because companies are seeking to improve their agility. SCCN solutions can be blended with other technologies to create control towers that do greatly improve a company’s agility.

- A control tower provides a digital model of a company’s extended supply chain. This is based on a canonical model of the supply chain. Marketplace style solutions – like those from E2open, Elemica, Infor Nexus, One Network, and Tesisquare – and data aggregation solutions – like those provided by resilinc, and RiskMethods -have the most robust digital threads.

- No canonical model is apt to be exactly right for a given company or industry. The model will need to be augmented. These SCCN digital twins are at best 70% fit to purpose. SCCN providers that provide tools to augment the canonical model are to be preferred. TraceLink is one example of a collaboration network provider that supplies these tools.

- Several SCCN vendors seek to be able to provide a network of networks. The message types they don’t provide they seek to pull into their network, transform those messages, and provide visibility based on their digital thread model.

- SCCN canonical models tend to be execution oriented. They help companies to orchestrate their supply chain. Orchestration uses visibility to enable relatively obvious and simple decisions when something unexpected occurs.

- Optimization allows for more complex decisions to be effectively made when things go wrong. Optimization depends upon the platform having a broad cost-to-serve optimization model. While some marketplace style SCCN vendors do have a platform with supply chain planning, none of these solutions currently offer robust concurrent planning. Concurrent planning links execution plans, the plan for the coming week or weeks, to a company’s longer-term integrated business plan (IBP). As new short-term scenarios and plans are created, the linkage to the revenue and profitability goals based on the longer-range IBP plan becomes instantly visible.

- Plan messages can include downstream data and industry data. These data streams improve forecasting. Coupa, E2open, and One Network provide visibility to this kind of data.

- Not all the data that flows into control towers will be SCCN data. SCCN suppliers with advanced integration capabilities can help provide visibility to internal and trading partner data that companies do not want to flow through a network. OpenText and IBM have both invested in building out a wide variety of integration tools.

The pandemic taught companies how important collaboration across the extended supply chain is. Supply chain management is now routinely talked about at the board level. Forecasting in the current environment is difficult, making it difficult to balance supply with demand. Supply issues have not disappeared; There are shortages of semiconductors, steel, and other commodities. Companies with global supply chains are finding ocean shipping a nightmare. The need for supply chain collaboration network solutions has become obvious.