I thought I understood all the major supply chain implications of the pandemic until I began reading Yossi Sheffi’s new book The New (Ab)Normal: Reshaping Business and Supply Chain Strategy beyond Covid-19. Jim Hackett, the CEO of Ford at the time, was quoted as saying: “We didn’t realize there was an off switch. We knew it might go into a recession, more like a dimmer switch, but off?” In some industries, the pandemic’s effects on demand were more sudden and severe than any recession scenario companies had planned for.

Now of course, companies must map out the potential impacts of the Russia Ukraine war. This week’s news will all center on this war. The potential supply chain impacts of this conflict dwarf any other supply chain news that might be reported.

Germany Freezes the Nord Stream 2 Project

The Potential Impact on the Electricity Prices

The Potential Impact on the Commodity Supply Chain

After months of troop buildups, attempted blackmail by Russian President Vladimir Putin to get policy concessions, failed diplomacy, and Russian lies about their peaceful intentions, Russia’s invasion of Ukraine began early Thursday morning. Russia had massed some 150,000 troops along Ukraine’s borders, according to US estimates based on satellite imagery. Ukraine does not have the military might to stop the invasion.

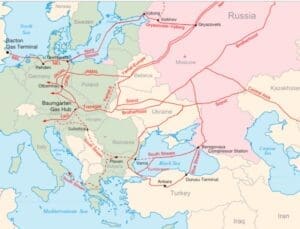

On Monday, Putin recognized the independence of two separatist regions in eastern Ukraine. Germany responded by halting certification of the Nord Stream 2 gas pipeline. Nord Stream 2 could deliver 55 billion cubic meters of gas per year. That’s more than 50% of Germany’s annual consumption and could be worth as much as $15 billion to Gazprom, the Russian state-owned company that controls the pipeline.

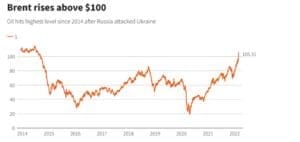

Oil prices jumped, with Brent rising above $105 a barrel for the first time since 2014, after Russia’s attack on Ukraine exacerbated concerns about disruptions to global energy supply. “Russia is the third-largest oil producer and second-largest oil exporter. Given low inventories and dwindling spare capacity, the oil market cannot afford large supply disruptions,” said UBS analyst Giovanni Staunovo in a Reuters article. Global oil supplies remain tight as demand recovers from pandemic lows. “Supply concerns may also spur oil stockpiling activity, which supports prices.”

Analysts believe that Brent is likely to remain above $100 a barrel until significant alternative supplies become available from OPEC, U.S. shale or Iran, for example. The United States and Iran have been engaged in indirect nuclear talks in Vienna that could lead to the removal of sanctions on Iranian oil sales. Ramping up shale oil suppliesSaudi Arabis has signaled they won’t pump more.

Fracking shale has made the U.S. the world’s largest producer of oil and gas and adds a layer of protection to the US supply. Recent oil busts, exacerbated by the pandemic, drove many producers to bankruptcy, but the rebound under way since early 2021 is transforming the economics of the shale industry once more. With oil over a $100 a barrel again, shale production is much more attractive. Shale companies have the unique ability to quickly ramp up or scale back production. Even before the invasion, ExxonMobil had announced plans to increase their production by 25% in the coming year. Chevron announced plans to increase their production by 10%. However, smaller shale players, who suffered more from this boom and bust market, are sticking to a “disciplined-growth strategy.”

But in terms of transportation, the impacts won’t just be on fuel prices. FourKites, a provider of real-time transportation visibility solutions, has a big data set around transportation. They apply their own human expertise plus machine learning to this Big Data to predict estimated times of arrivals and pricing. Carriers, freight forwarders, and shippers that were dealing with the China to North America trade lanes were already operating in crisis mode. It will get worse – the invasion will create major new constraints on Asian ocean and air exports with spot container pricing. 336,500 TEUs were transported from China to the EU by rail in the first six months of 2021, that is 44% more than 2020 and 99% more than in 2019. Those shipments need to go by Ocean or the more expensive Air mode if ship berths can’t be found.

Because of this, they are predicting rates will skyrocket for Ocean and Air. They are predicting Ocean is going to increase 2-3x from $10,000 to container to over $30,000 per container and that Air freight spot rates and lead times are going to increase 3-4 times.

While rising gas prices drive up the price of transportation, rising natural gas prices also affect global supply chains. Natural gas has become increasingly important in generating electricity. In the US, for example, natural gas accounted for 40% of total utility-scale U.S. electricity generation in 2020.

These rising prices can cut into the profits of manufacturers, distributors, and retailers who are reliant on this form of energy for powering their facilities. Energy cost increases, in turn, often lead these companies to raise their prices. This is particularly true in Europe, where Russia is the largest provider of natural gas to Europe, providing about 35% of its supply. The fight over Nord Stream 2 shouldn’t dramatically change the price outlook for natural gas this winter. The pipeline hadn’t been expected to come online until the second half of the year. However, about 10% of the total supply of liquid natural gas (LNG) flows though Ukraine to the European Union. These pipelines could be damaged in the fighting, or Ukraine could decide to cut them, or Russia, which has already reduced its gas exports to Europe, might decide to restrict exports further in response to Western sanctions.

LNG from the United States and Qatar will help the EU to withstand disruptions to gas flows though Ukraine. But if the supply is totally cut off, the impacts will be dire.

Interos, a company providing supply chain risk management solutions, did an analysis of likely impacts on the global raw material and commodity supply chains. While the impacts of disruption of trade between US and Europe and Russian and Ukraine are miniscule in comparison to the disruption of trade with China that occurred because of the pandemic, the impacts are not insignificant.

“More than 2,100 U.S.-based firms and 1,200 European firms have at least one direct (tier-1) supplier in Russia. More than 450 firms in the U.S. and 200 in Europe have tier-1 suppliers in Ukraine. Software and IT services account for 13% of supplier relationships between U.S. and Russian/Ukrainian companies. Consumer services represent another 7%. About 6% account for trading and distribution services and 4% for industrial machinery. Oil, gas, steel and metal products account for other everyday items purchased from the two countries.” In terms of trade, these are not critical, single-sourced Tier 1 inputs needed in manufacturing.

But the impacts get larger as we move from direct Tier 1 impacts to indirect Tier 2 or 3 relationships. “More than 190,000 firms in the U.S. and 109,000 firms in Europe have Russian or Ukrainian suppliers at tier 3. More than 15,100 firms in the U.S. and 8,200 European firms have tier-2 suppliers based in Ukraine.”

Food inflation is a risk from a supply chain disruption. “Ukraine is on track to being the world’s third-largest exporter of corn, and Russia is the world’s top wheat exporter. Ukraine is also a top exporter of barley and rye.”

The conflict could squeeze metal markets. Russia controls roughly 10% of global copper reserves and is also a significant producer of nickel and platinum. Nickel has been trading at an 11-year high, and further price increases for aluminum are likely with any disruption in supply caused by the conflict.

Russia, along with the United States, China, Israel and the United Kingdom – are believed to have the most developed cyber warfare capabilities. Russia has been one of the most aggressive nations in deploying these capabilities. Russia is strongly believed to have used cyber weapons to attack Georgia during the military incursion into the country in 2008. In early 2014, the Cyber Snake program that attacked the Ukraine is believed to be of Russian origin.

In the Interos article they stated that the 2017 NotPetya attack on Ukrainian tax reporting software spread across the world in a matter of hours. The attack disrupted ports, shut down manufacturing plants, and hindered the work of government agencies. The Federal Reserve Bank of New York estimated that victims of the attack, including Maersk, Merck and FedEx, lost a combined $7.3 billion.

Further, Russian anger at sanctions could lead to cyber warfare directed at the West. The spread of Public Cloud enterprise software has made the risks greater. Shutting down a large Cloud player could impact the ability of tens of thousands of companies to effectively manage their supply chains. Of all the potential impacts of a war between Russia and Ukraine, this is potentially the most dire prospect.

This week’s song – What I Am – is from Eddie Brickell and the New Bohemians.