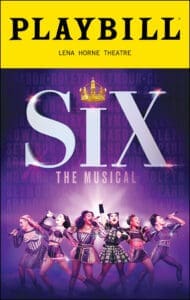

I spent the beginning part of the week in New York attending the NRF Big Show. It was a very busy show, with more than 35,000 attendees walking the floors of the Javits Center. I certainly saw a lot of exhibitors touting their AI capabilities, especially when it came to more informed decision making across the entire supply chain network. But I will get into the details in a future article. While I was in New York, I had the opportunity to see the musical Six. For those of you that are unfamiliar with the show, Six is a modern retelling of the lives of the six wives of Henry VIII, presented in the form of a pop concert. In the show, each of the wives, Catherine of Aragon (divorced), Anne Boleyn (beheaded), Jane Seymour (died), Anna of Cleves (divorced), Katherine Howard (beheaded), and Catherine Parr (survived), take turns telling their story to determine who suffered the most during their life and marriage to Henry VIII. It is essentially a battle royale of misery (in comedic form), and the winner will be the lead singer of the newly formed pop group. Each of the wives tells their story in the style of a famous singer, ranging from Beyonce to Britney Spears. I won’t spoil the ending for you, but it was an incredible show, and I highly recommend it to anyone who is in New York. And now on to this week’s logistics news.

I spent the beginning part of the week in New York attending the NRF Big Show. It was a very busy show, with more than 35,000 attendees walking the floors of the Javits Center. I certainly saw a lot of exhibitors touting their AI capabilities, especially when it came to more informed decision making across the entire supply chain network. But I will get into the details in a future article. While I was in New York, I had the opportunity to see the musical Six. For those of you that are unfamiliar with the show, Six is a modern retelling of the lives of the six wives of Henry VIII, presented in the form of a pop concert. In the show, each of the wives, Catherine of Aragon (divorced), Anne Boleyn (beheaded), Jane Seymour (died), Anna of Cleves (divorced), Katherine Howard (beheaded), and Catherine Parr (survived), take turns telling their story to determine who suffered the most during their life and marriage to Henry VIII. It is essentially a battle royale of misery (in comedic form), and the winner will be the lead singer of the newly formed pop group. Each of the wives tells their story in the style of a famous singer, ranging from Beyonce to Britney Spears. I won’t spoil the ending for you, but it was an incredible show, and I highly recommend it to anyone who is in New York. And now on to this week’s logistics news.

- Red Sea news:

- Uber cuts off alcohol delivery it app Drizly

- California ports are winning back imports

- Logistics groups criticize White House move to define more workers as employees

- US energy tax credit trading grows to as much as $9 billion

- Coca-Cola, Hillenbrand seeking circular plastic case studies

The Houthi attacks in the Red Sea are not only driving up sea freight, but air freights are going to get higher too, as global trade flows get increasingly disrupted. In the past weeks, ocean freight rates have risen as much as $10,000 per 40-foot container, as container ships seeking to avoid the attacks embarked on long detours around the Cape of Good Hope in South Africa, diverting more than $200 billion of cargo away from the critical trade artery. The delays to maritime trade may prompt some retailers to switch to air freight, as companies that normally ship their goods by sea want to ensure faster delivery. This means that air cargo is about to play an expanded role in the supply chain ecosystem. Air freight can slash delivery times to just a few days compared to weeks taken by ocean carriers. With the anticipated influx of ocean to air conversions, air freight rates are expected to rise.

The Houthi attacks in the Red Sea are not only driving up sea freight, but air freights are going to get higher too, as global trade flows get increasingly disrupted. In the past weeks, ocean freight rates have risen as much as $10,000 per 40-foot container, as container ships seeking to avoid the attacks embarked on long detours around the Cape of Good Hope in South Africa, diverting more than $200 billion of cargo away from the critical trade artery. The delays to maritime trade may prompt some retailers to switch to air freight, as companies that normally ship their goods by sea want to ensure faster delivery. This means that air cargo is about to play an expanded role in the supply chain ecosystem. Air freight can slash delivery times to just a few days compared to weeks taken by ocean carriers. With the anticipated influx of ocean to air conversions, air freight rates are expected to rise.

The attacks in the Red Sea are having an impact on global trade, aside from rising prices. Global trade declined by 1.3 percent from November to December 2023 as militant attacks on merchant vessels in the Red Sea led to a plunge in the volumes of cargo transported in that key region, a German economic institute said on Thursday. Currently around 200,000 containers are being transported via the Red Sea daily, down from some 500,000 per day in November, the IfW Kiel institute said. Diversions in response to the attacks have led to journeys between Asian production centers and European consumers taking up to 20 days longer. Shipping giants such as Maersk and Hapag-Lloyd have been sending their vessels on longer, more expensive journeys around South Africa’s Cape of Good Hope.

Red Sea diversions mean container lines need more ships to carry the same amount of cargo. The security situation — which is even more precarious in the near term due to coalition air strikes in Yemen — has already driven spot container freight rates much higher. Now it is starting to push up the price container lines pay to rent ships. The initial diversions away from the Red Sea caused delays in return trips to Asia, prompting liners to charter ships for short terms as “extra loaders” to pick up the slack. Now that diversions are more ensconced, liners will need to add additional vessels to service strings to maintain weekly schedules, given the longer voyage distance around the Cape of Good Hope. To the extent new buildings and existing fleets don’t fill the gap, they would need to charter or buy more ships. The Harpex index, which measures six- to 12-month charter rates for ships with capacity of up to 8,500 twenty-foot equivalent units, has risen 12 percent since mid-December.

Uber is shutting down alcohol delivery app Drizly, the company confirmed, three years after acquiring the platform for $1.1 billion. Drizly will officially shut down at the end of March, Uber told The Associated Press. That means orders are open until then, Drizly said in details posted on X, the platform formerly known as Twitter. In a prepared statement, Uber’s senior vice president of delivery Pierre Dimitri Gore-Coty said that the company decided to close Drizly’s business and “focus on our core Uber Eats strategy of helping consumers get almost anything — from food to groceries to alcohol — all on a single app.” Uber purchased Drizly in a cash-and-stock deal back in 2021. The Boston-based subsidiary continued to operate as a standalone app, with its marketplace also integrated into the Uber Eats platform. Drizly currently delivers beer, wine and spirits in states where it’s legal, and partners with retailers across North America. Regulators accused the alcohol delivery app of security failures several years ago that exposed personal information of some 2.5 million customers. To resolve these allegations, Drizly later agreed to tighten security and limit data collection.

Uber is shutting down alcohol delivery app Drizly, the company confirmed, three years after acquiring the platform for $1.1 billion. Drizly will officially shut down at the end of March, Uber told The Associated Press. That means orders are open until then, Drizly said in details posted on X, the platform formerly known as Twitter. In a prepared statement, Uber’s senior vice president of delivery Pierre Dimitri Gore-Coty said that the company decided to close Drizly’s business and “focus on our core Uber Eats strategy of helping consumers get almost anything — from food to groceries to alcohol — all on a single app.” Uber purchased Drizly in a cash-and-stock deal back in 2021. The Boston-based subsidiary continued to operate as a standalone app, with its marketplace also integrated into the Uber Eats platform. Drizly currently delivers beer, wine and spirits in states where it’s legal, and partners with retailers across North America. Regulators accused the alcohol delivery app of security failures several years ago that exposed personal information of some 2.5 million customers. To resolve these allegations, Drizly later agreed to tighten security and limit data collection.

U.S. importers are rediscovering the lure of Southern California ports. Trade is swinging back to the ports of Los Angeles and Long Beach after a period in which pandemic-driven shipping disruptions and broader shifts in manufacturing pushed supply chains more heavily toward Gulf Coast and East Coast ports. The Southern California ports in September, October and November recorded year-over-year increases in containerized imports of between 17% and 31%, according to ports data. At the same time imports fell at East Coast gateways such as Georgia’s Port of Savannah and the Port of New York and New Jersey. Logistics executives say the neighboring Southern California ports, long the anchor of U.S. supply chains built on trade with Asia, are winning back business in part because of improved labor relations with dockworkers following resolution of long-running contract talks last year.

U.S. importers are rediscovering the lure of Southern California ports. Trade is swinging back to the ports of Los Angeles and Long Beach after a period in which pandemic-driven shipping disruptions and broader shifts in manufacturing pushed supply chains more heavily toward Gulf Coast and East Coast ports. The Southern California ports in September, October and November recorded year-over-year increases in containerized imports of between 17% and 31%, according to ports data. At the same time imports fell at East Coast gateways such as Georgia’s Port of Savannah and the Port of New York and New Jersey. Logistics executives say the neighboring Southern California ports, long the anchor of U.S. supply chains built on trade with Asia, are winning back business in part because of improved labor relations with dockworkers following resolution of long-running contract talks last year.

Industry groups from every corner of the logistics sector are criticizing a White House policy released Tuesday that would swing U.S. Department of Labor (DOL) standards toward classifying many workers as employees instead of independent contractors. The long-running debate over that topic could have a large impact on companies that rely on contractors, including supply chain and transportation companies that hire over the road truckers and gig workers to deliver freight loads. The new Biden Administration standard rescinds a policy known as the 2021 Independent Contractor Rule, a Trump-era policy that logistics experts have called favorable to classifying workers as independent contractors. In its place, the new regulation creates a less predictable framework that increases the likelihood of determining that a worker has employee status under the Fair Labor Standards Act (FLSA), the federal statute that governs minimum wage and overtime pay. The regulation is slated to take effect on March 11, although it may be challenged in court before that happens.

Developers of renewable energy projects selling unused U.S. tax credits to other companies now account for a market worth between $7 billion and $9 billion, buoyed by legislation in 2022 that made these trades possible, a new study, opens new tab shows. President Joe Biden’s climate law, aimed to stoke trillions of dollars of investment to wean the economy off planet-warming fossil fuels, partly through tax breaks for builders of projects like wind farms and solar plants. The government made some of these new credits tradable, in the hope of bringing fresh money to projects which have long relied on a group of banks that are big and expert enough to invest directly and take the associated tax breaks. In the first six months since tax authorities set guidance for the trades in June of last year, deals were struck to transfer credits worth between $7 billion and $9 billion.

Developers of renewable energy projects selling unused U.S. tax credits to other companies now account for a market worth between $7 billion and $9 billion, buoyed by legislation in 2022 that made these trades possible, a new study, opens new tab shows. President Joe Biden’s climate law, aimed to stoke trillions of dollars of investment to wean the economy off planet-warming fossil fuels, partly through tax breaks for builders of projects like wind farms and solar plants. The government made some of these new credits tradable, in the hope of bringing fresh money to projects which have long relied on a group of banks that are big and expert enough to invest directly and take the associated tax breaks. In the first six months since tax authorities set guidance for the trades in June of last year, deals were struck to transfer credits worth between $7 billion and $9 billion.

U.S.-based packaging technology provider Hillenbrand Inc. is working with The Coca-Cola Co. and nonprofit group Net Impact to co-host the second Circular Plastics Case Competition, which encourages emerging business professionals to rethink the plastics value chain by designing innovative solutions that help keep plastics in the economy and out of the environment. This year, the case competition is asking participants to explore how to increase the supply of recycled-content polyethylene terephthalate (rPET). Case study submissions are due in March, and in May, finalists will make online presentations that will be broadcast during the NPE event in Chicago. The eventual first-place winner will be awarded $10,000, followed by $2,500 for second place and $1,000 for third place.

That’s all for this week. Enjoy the weekend and the song of the week, Don’t Lose Your Head, Anne Boleyn’s song from the Six soundtrack.