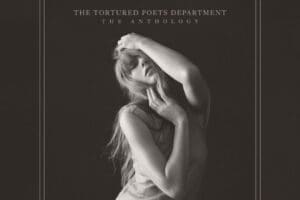

After months of anticipation, the day is finally here. On February 4 at the 2024 Grammy Awards, Taylor Swift announced that she would be releasing a new album, which had secretly been in the works for two years. The album, The Tortured Poets Department, was released overnight. But in a shocking twist, just two hours later, Swift surprise-released a 15-track expansion of the album, dubbed The Tortured Poets Department: The Anthology. The album features collaborations with Post Malone and Florence & the Machine, with a video for the debut single Fortnight set to drop tonight. I’ve listened to about half the album so far this morning (my daughters have finished it and are ready for round 2). You can check out this week’s song of the week for my favorite so far. And now on to this week’s logistics news.

After months of anticipation, the day is finally here. On February 4 at the 2024 Grammy Awards, Taylor Swift announced that she would be releasing a new album, which had secretly been in the works for two years. The album, The Tortured Poets Department, was released overnight. But in a shocking twist, just two hours later, Swift surprise-released a 15-track expansion of the album, dubbed The Tortured Poets Department: The Anthology. The album features collaborations with Post Malone and Florence & the Machine, with a video for the debut single Fortnight set to drop tonight. I’ve listened to about half the album so far this morning (my daughters have finished it and are ready for round 2). You can check out this week’s song of the week for my favorite so far. And now on to this week’s logistics news.

- Walmart in the news:

- Amazon has become the largest private EV charging operator

- Biden calls for steep hike to tariff on Chinese steel

- S. cargo imports in May could hit highest level since last October

- Transloading is heating up again

- Hundreds of cargo ships lost propulsion in U.S. waters in recent years

- Ocean freight rates expected to jump after Iran seizes containership

Walmart Canada is launching a national pilot program for customers to recycle their reusable shopping bags. Under the plan, customers will be able send in their extra or damaged Walmart reusable blue shopping bags to TerraCycle who will either wash and donate them to charity partners, including Food Banks Canada, or recycle them. Recycled bags will be processed into raw materials that can be used to make things like shipping pallets and outdoor furniture, Walmart said. Customers looking to participate can sign up for the program on TerraCycle’s website. According to TerraCycle, bags can be sent in a box or shipping envelope — you need a minimum of five bags for a shipment — and the program provides a free shipping label. Canada banned single-use plastic shopping bags in December 2022, along with other single-use plastic items including straws and cutlery.

Walmart Canada is launching a national pilot program for customers to recycle their reusable shopping bags. Under the plan, customers will be able send in their extra or damaged Walmart reusable blue shopping bags to TerraCycle who will either wash and donate them to charity partners, including Food Banks Canada, or recycle them. Recycled bags will be processed into raw materials that can be used to make things like shipping pallets and outdoor furniture, Walmart said. Customers looking to participate can sign up for the program on TerraCycle’s website. According to TerraCycle, bags can be sent in a box or shipping envelope — you need a minimum of five bags for a shipment — and the program provides a free shipping label. Canada banned single-use plastic shopping bags in December 2022, along with other single-use plastic items including straws and cutlery.

In a Calgary warehouse almost as big as eight football fields, an army of robots whir about, carrying massive quantities of merchandise bound for Walmart Canada customers. Some of the robots zip around the hulking facility transporting pallets of merchandise fresh off delivery trucks. Another resembling a giant arm moves the pallets onto conveyor belts. A third group are labelers. Together, they shave down the time it takes to get products from trailers into the facility by 90 per cent — and their overlord, Walmart Canada, hopes this is just the start. It plans to bring robots to Mississauga and Cornwall, Ont., distribution centers over the next five years.

Amazon has put 10,000 Rivian electric delivery vehicles on the road in recent years, with plans to put another 90,000+ on the road soon. In a little more than two years, Amazon has installed more than 17,000 chargers at about 120 warehouses around the US, making the retail giant the largest operator of private electrical vehicle charging infrastructure in the country. However, Amazon has backed away from a vow to make half of all deliveries with zero carbon pollution by 2030, saying that initiative was superseded by broader climate goals. But the company has come farther and faster in the transition to EVs than most of its competitors. Amazon has a long way to go, as the company says its operations emitted about 71 million metric tons of carbon dioxide equivalent in 2022, up by almost 40 percent since Jeff Bezos’s 2019 vow that his company would eventually stop contributing to the emissions warming the planet. But Amazon is on track to purchase by next year as much electricity produced by solar, wind and other carbon-free sources as it uses to power its operations.

Amazon has put 10,000 Rivian electric delivery vehicles on the road in recent years, with plans to put another 90,000+ on the road soon. In a little more than two years, Amazon has installed more than 17,000 chargers at about 120 warehouses around the US, making the retail giant the largest operator of private electrical vehicle charging infrastructure in the country. However, Amazon has backed away from a vow to make half of all deliveries with zero carbon pollution by 2030, saying that initiative was superseded by broader climate goals. But the company has come farther and faster in the transition to EVs than most of its competitors. Amazon has a long way to go, as the company says its operations emitted about 71 million metric tons of carbon dioxide equivalent in 2022, up by almost 40 percent since Jeff Bezos’s 2019 vow that his company would eventually stop contributing to the emissions warming the planet. But Amazon is on track to purchase by next year as much electricity produced by solar, wind and other carbon-free sources as it uses to power its operations.

President Biden called for raising tariffs on imports of steel and aluminum from China, beginning what is expected to be a broadside of protectionist steps against Beijing during a presidential election in which trade is a flashpoint. Biden is asking his trade officials to more than triple a key tariff rate on Chinese steel and aluminum products to 25 percent from 7.5 percent. That higher levy would be in addition to a separate 25 percent tariff on steel and a 10 percent duty on aluminum imposed under the Trump administration. A senior administration official said the higher tariffs would only affect 0.6 percent of U.S. demand for steel. Biden’s move comes as the administration is studying raising tariffs on a range of Chinese exports to the U.S., including electric vehicles, batteries and solar products. The higher metal levies would go into effect as part of the Biden administration’s decision on how to adjust tariffs that date from former President Donald Trump’s time in the White House, senior Biden administration officials said.

President Biden called for raising tariffs on imports of steel and aluminum from China, beginning what is expected to be a broadside of protectionist steps against Beijing during a presidential election in which trade is a flashpoint. Biden is asking his trade officials to more than triple a key tariff rate on Chinese steel and aluminum products to 25 percent from 7.5 percent. That higher levy would be in addition to a separate 25 percent tariff on steel and a 10 percent duty on aluminum imposed under the Trump administration. A senior administration official said the higher tariffs would only affect 0.6 percent of U.S. demand for steel. Biden’s move comes as the administration is studying raising tariffs on a range of Chinese exports to the U.S., including electric vehicles, batteries and solar products. The higher metal levies would go into effect as part of the Biden administration’s decision on how to adjust tariffs that date from former President Donald Trump’s time in the White House, senior Biden administration officials said.

Inbound cargo volume at the nation’s major container ports in the month of May is expected to top 2 million units for the first time since last fall, as imports grow despite new supply chain challenges, according to the Global Port Tracker report released today by the National Retail Federation (NRF) and Hackett Associates. While it is not expected to have a national impact, the tragic collapse of the Francis Scott Key Bridge shows the ongoing need for flexibility and resiliency in every company’s supply chain. Baltimore is not included in Global Port Tracker’s national totals because its data is reported later than other ports. But as the Port of Baltimore has been closed to vessel traffic since a container ship struck a major bridge on March 26, the shutdown is having a regional impact because cargo that would normally go there is being diverted to other East Coast ports. The port handled 48,000 twenty-foot equivalent units (TEUs) in January.

A logistics strategy called transloading, used by trucking companies during the pandemic to ease the container backlog, is increasing in popularity again after U.S. West Coast ports have started to receive higher volumes of containers that are being diverted away from the East Coast. Transloading is the process of moving freight from truck to rail or rail to truck. Logistics companies tell CNBC that U.S. importers are requesting this type of service more frequently as they move more freight on new routes as a result of the Red Sea diversions and the Panama Canal drought restrictions. The February Transportation Intelligence report from economic forecasting firm FR showed that U.S. imports moved inland via transload in 2023 were between 65-70 percent percent, compared to 2021 when it was less than 60 percent.

Less than two weeks after Baltimore’s Francis Scott Key Bridge was destroyed by an out-of-control cargo ship, another huge container ship passed beneath a busy bridge connecting New York and New Jersey and then suddenly decelerated in a narrow artery of one of the nation’s largest ports. Three tug boats helped shepherd the APL Qingdao from where it lost propulsion near the Bayonne Bridge to a safe location, authorities said. The ship dropped anchor just upstream from the even busier Verrazzano-Narrows Bridge, which carries about 200,000 vehicles per day. The April 5 incident is one of hundreds in which massive cargo ships lost propulsion, many near bridges and ports, according to a Washington Post analysis of Coast Guard records. The findings indicate that the kind of failure that preceded the March 26 Baltimore bridge collapse — the 984-foot Dali is believed to have lost the ability to propel itself forward as it suffered a more widespread power outage — was far from a one-off among the increasingly large cargo ships that routinely sail close to critical infrastructure.

Less than two weeks after Baltimore’s Francis Scott Key Bridge was destroyed by an out-of-control cargo ship, another huge container ship passed beneath a busy bridge connecting New York and New Jersey and then suddenly decelerated in a narrow artery of one of the nation’s largest ports. Three tug boats helped shepherd the APL Qingdao from where it lost propulsion near the Bayonne Bridge to a safe location, authorities said. The ship dropped anchor just upstream from the even busier Verrazzano-Narrows Bridge, which carries about 200,000 vehicles per day. The April 5 incident is one of hundreds in which massive cargo ships lost propulsion, many near bridges and ports, according to a Washington Post analysis of Coast Guard records. The findings indicate that the kind of failure that preceded the March 26 Baltimore bridge collapse — the 984-foot Dali is believed to have lost the ability to propel itself forward as it suffered a more widespread power outage — was far from a one-off among the increasingly large cargo ships that routinely sail close to critical infrastructure.

Maritime industry experts are projecting a surge in freight rates and insurance charges—known as war risk premiums—following the move by Iranian military forces on Saturday to seize a commercial container ship near the Strait of Hormuz. The increases would be similar to price hikes that happened in January when many ocean freight carriers began to avoid the Red Sea and the Suez Canal in an effort to dodge missiles and drones being launched by Houthi rebels in Yemen. But the latest incident could trigger a more global response, affecting oil prices, shipping routes, and energy security. In the latest example of regional violence rippling out from Israel’s war with Hamas and Palestine, Iranian Navy special forces used a helicopter to forcefully board the MSC Aries, which is operated by maritime giant MSC but owned by an Israeli company, according to published reports. The seizure happened the same day that Iran fired hundreds of drones and missiles against Israel in retaliation for Israel’s earlier raid on the Iranian consulate in Syria.

That’s all for this week. Enjoy the weekend and the song of the week, The Tortured Poets Department by Taylor Swift.