Following 45 days of negotiations, the European Council approved a watered-down version of the Corporate Sustainability Due Diligence Directive. The EU CSDDD has had a difficult journey, facing delays, changes, and hurdles to overcome. Nonetheless, the direction of travel of European governments is clear: companies need to do more to identify their exposure to unethical practices, human rights abuses, and significant adverse environmental issues, across their value chain. The German Supply Chain Act is currently setting the benchmark in Europe, but in the United States, the Uighur Forced Labor Prevention Act (UFLPA) is a significant force. This wave of new legislation is pushing companies to understand and evaluate their supply chain in much greater depth than ever before.

Before the EU Council approved the directive, the original directive was aimed to impact companies of +500 employees with a net turnover of 150 million but after deliberation, these numbers have been increased to +1,000 employees and a turnover of 450 million euros. With the recent changes to the directive, the number of companies impacted is about .05% of the total number of businesses operating within the EU.

The CSDDD will be phased in over an extended time, starting in 2027 companies with 5,000 employees and a 1.5 billion euros turnover will need to report. By 2029, companies with 1,000 employees and 450 million euros turnover will be impacted.

The directive aims to foster “sustainable and responsible corporate behavior and to anchor human rights and environmental considerations in companies’ operations and corporate governance.” The core elements of this duty are identifying, ending, preventing, mitigating, and accounting for negative human rights and environmental impacts in the company’s operations, subsidiaries, and value chains.

What will be required of companies?

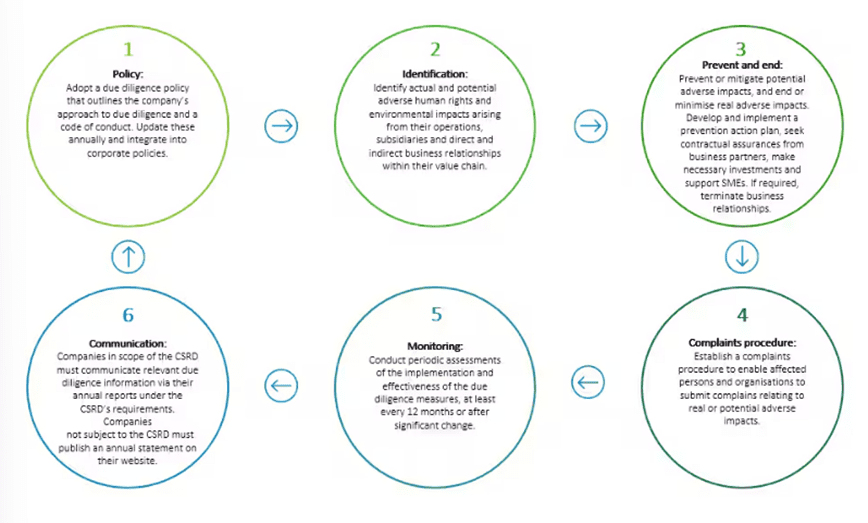

Source: Deloitte

The CSDDD is still awaiting final approval, but the core due diligence steps will require companies to identify potential, and actual adverse human rights and environmental impacts. Not limited to their operations but across subsidiaries and value chains. They will have to follow the six steps listed above which closely resemble the OECD Due Diligence Guidance For Business Conduct. In addition to preventing and ending adverse impacts, companies will also need to verify that their direct and indirect business partners comply with the same steps and actions. This can be done by an independent third party or a selected industry intuitive to complete the verification. In the instance that a company does identify potential or adverse impacts within its value chain, it is encouraged to engage with the value chain members instead of cutting relationships.

Under the proposed rules companies will be liable for damages and impacts, if unable to prevent them from happening or if an impact has already occurred. People who were affected will be able to claim compensation and bring forward legal action.

One of the major pieces of this regulation is that the CSDDD is the first EU law that will mandate companies to adopt a “Climate Transition Plan” by the Paris Agreement. This is surprising due to the EUs outspokenness on its dedication to the Paris Agreement set in 2015. The public sector can only pass so many laws to decarbonize sectors, eventually, the governments will apply pressure on companies to begin establishing concrete plans to decarbonize their operations as well.

This past month, Dow Jones launched a solution to reduce the burdensome processes of conducting a risk analysis on a company value chain. In a briefing with, Gavin Proudley, Head of Third-Party Risk Proposition, Dow Jones Risk & Compliance he answered some questions about the “Dow Jones Integrity Check” solution. Which leverages the power of AI and Gen AI by bridging the gap between higher expectations of companies and resource constraints. This solution can offer compliance teams an efficient way of identifying and interrogating risks associated with their suppliers, creating a new layer of investigation that can be leveraged at scale. Advances in natural language processing have made it possible to screen high volumes of names and entities against unstructured data sets, which often contain ESG red flags that are not captured in traditional structured lists. Add GenAI into the mix, and it is now possible to conduct an initial due diligence report in minutes rather than days. Dow is touting that automating the due diligence process is going to reshape the way organizations manage and mitigate third-party risk in response to the raft of new legislation in this space. When organizations are tackling an issue as complex as modern slavery, the ability to conduct an enhanced due diligence analysis at a scale will bring a major change to the way and speed that exploitation is detected and prevented.