Achieving robust forecasts is very difficult, if not impossible, in some industries. This is particularly true for companies in the semiconductor industry, which is very volatile because of its speed of innovation. Moore’s Law describes a long-term trend in the history of computing hardware, in which the number of transistors that can be placed inexpensively on an integrated circuit has doubled approximately every two years (equivalent to about 30 percent cost reductions per year). This leads to very short product lifecycles. The industry also suffers from periodic boom and bust cycles.

In this environment, a highly accurate demand forecast will never be reached. But even though you can’t achieve high forecast accuracy, you can (and should) measure your forecast accuracy and attempt to improve it. A company’s goal should be to have cost-effective forecast accuracy that exceeds what most of company’s competitors can achieve.

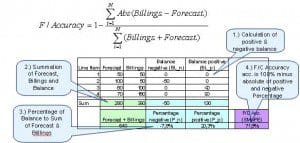

There are various measures of forecast accuracy and statisticians argue about the merits of the different formulas. One semiconductor company that I know uses Symmetric Mean Aboslute Percentage Error (SMAPE), partially because some of its competitors also use that measure. Because this company belongs to an association that provides industry benchmark data, the company can benchmark itself against its competitors.

In a collaborative forecast process a company can ask its customers what they anticipate to buy in a given time period, and then use these inputs in its forecast. SMAPE allows a company to show its customers the accuracy of their inputs and use this as a tool for continuous improvement.

In the semiconductor industry, however, improved forecasting can only take you so far. A better forecast can save your company money by reducing inventory carrying costs and obsolescence. But because of the boom and bust nature of this industry, semiconductor companies also need extremely flexible supply chains. Insightful network design, clever procurement contracts with key suppliers and contract manufacturing partners, and alternative routings through their multi-step production process are some of the things semiconductor companies can do to effectively flex their supply chains up and down.