The financial supply chain needs more attention than it usually gets. Traditionally, the focus of supply chain management is on the movement of finished goods and raw materials across the value chain. But companies also need to pay attention to the flow of money. The movement of money happens in the form of bank credits or with the help of other financial institutions. Often these methods do not work well for medium to small suppliers who frequently are cash constrained and need to free up their working capital more quickly. There are solutions available in the market to facilitate credit retrieval, but banks are financing the receivables of small suppliers, which involves risk and requires the banks to investigate the relationships between buyers and the suppliers (their customers) in those chains. This drives up the fees paid by small suppliers. Another major issue with small and medium enterprises in emerging regions is the cost of capital. The rates can be between 7-10 percent which is difficult to afford.

One solution would be to get the suppliers, buyers, and financial institutions on one platform. But, this has been a challenge. Better integration between the physical and the financial supply chain can lead to improvements in both the physical and the financial supply chains.

A partnership between GT Nexus and International Finance Corporation (IFC) facilitates such an arrangement through a program called Global Trade Supplier Finance (GTSF) focused mainly on the financing option for small and medium suppliers based in emerging countries. GT Nexus, with its cloud-based platform, connects local exporters in countries like Bangladesh with their global trading partners and IFC. In 2013, GT Nexus merged with TradeCard, which offered financial supply chain capabilities to a large network of suppliers, retailers and service providers. Complemented with GT Nexus’ GTM and TMS solutions the capabilities became more holistic. “In the movement of goods, money and data, if all three are synchronized, a new and innovative set of capabilities can be brought about,” said Kurt Cavano, Vice Chairman and Chief Strategy Officer of GT Nexus in an interview with ARC Advisory Group.

How Does it Work?

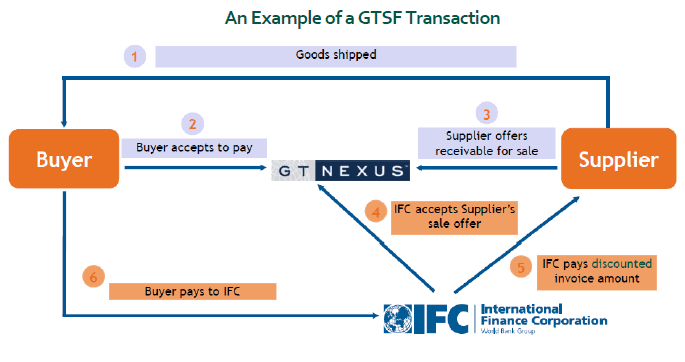

The supplier is provided a set of tools to help pack and ship accurately and produce fulfillment documents in compliance with the buyer’s purchase order terms and conditions. The supplier ships the goods and invoice (or invoices) to the buyer and can choose to discount for immediate payment to the bank. A compliance process will bring about a payment decision while goods are practically still at origin. Provided compliance has been met or any discrepancies are approved, an irrevocable commitment to pay on the part of the buyer is brought about as a result of the legal framework of the platform. After having assured the IFC’s business rules have been met, a funding notice is then sent to the IFC.

Buyers benefit from a more stable supply chain and extended payment terms, while suppliers benefit with a flexible and cost-competitive financing facility. Suppliers receive immediate payments for buyer-approved invoices. All the transactions are carried out in the GT Nexus platform. Even if a delivery is completed before the due date, the payment is made if approved by the buyer. In some countries, IFC offers as low as 3 percent Annual Percentage Rate (APR), which is much lower than the industry norms.

A pictorial representation of the workflow is shown below.

The larger benefit of the GTSF Program goes beyond just the financing aspect. The program can be used as an incentive for suppliers to adhere to acceptable working and safety conditions (like safety exits, proper ventilation, and access to fire extinguishers). Essentially, factories can get better financing rates if they take steps toward ensuring better working conditions. IFC hires third party audit inspectors to check for the compliance and subcontracting issues. ARC has written about the problems of subcontracting and how audits can help (Social Audits Can Mitigate Outsourcing Risks in Asia).

These kinds of programs are already in place for brands like Levi Strauss & Co., Columbia, and many more. These buyers work with suppliers such as MBM Group (Bangladesh), MAS (Sri Lanka) and Brandix (Sri Lanka) who are a part of this program.