Economists are beginning to speak of “immaculate disinflation.” This new concept argues that when inflation is caused by supply chain issues – like demand/supply mismatches, difficulty in securing products from China, port problems, energy inflation caused by a war in the Ukraine, and so forth – the Federal Reserve does not have to do anything to bring the inflation rate down; inflation will decrease by itself when the supply issues are resolved – as they inevitably are over time.

For example, shippers spent much of last year bemoaning soaring ocean shipping rates and ships waiting for days to unload once they reached their destination port. But SHIFEX, the freight forwarder rate index, recently recorded the lowest ocean freight rate between China and the port of Long Beach in 24 months —a rate of $3,500 to move a 40-foot container. This is an 80% drop year on year drop.

When the Federal Reserve (the Fed) believes inflation is too high, they raise interest rates. Raising interest rates leads to manufacturers deciding to forego capital investments; construction slowing down; declining sales of white goods, cars and trucks; and pressure on banks. Ultimately, this slow down in economic activity ripples through the economy. Sometimes, a “soft landing” is achieved, and the economy does not plunge into recession. But often recessions are the result.

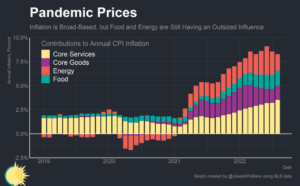

So, the question for economists is what proportion of the 8.3% inflation rate will go down by itself, because the cause is mostly caused by supply chain issues? But leading economists, like Paul Krueger and Joseph Politano, have concluded that immaculate disinflation will not solve the problem. The Fed will need to raise rates. The inflation rate is so high that the Fed has signaled it will aggressively and relentlessly raise rates until inflation is under control. In short, a recession is highly likely.

There is a playbook for companies facing a recession. It is difficult to forecast dropping demand. The signals tend to lag what is happening in the market and companies tend to be slow to cut production. So, if a recession appears likely, companies need to error on the side of a conservative forecast, be prepared to lay off workers sooner rather than later, and start drawing down their safety stock inventory.

Many companies work to conserve cash by paying their vendors more slowly. This needs to be done carefully, a company needs to make sure they don’t force their key vendors into bankruptcy. Meanwhile, supply chain risk management solutions can be used to monitor the financial health of upstream vendors so that alternative sources of supply can be secured promptly if key vendors are in trouble. Supply chain risk management applications have begun to solve the very difficult problem of identifying and monitoring vendors several echelons upstream in their supply chain.

Rising unemployment appears to be inevitable. There is also a right way and a wrong way to handle layoffs. In one comprehensive survey of 1,000 recently laid off workers, 65% say their employer could have done a better job handling the layoff. In terms of notice, most workers believe layoffs should always be communicated in person, as opposed to virtually. Americans want at least two months of severance pay but only 27% of laid-off employees receive severance pay.