The reason that microgrids are growing faster than larger grids comes down to economics. In many cases microgrids are now bankable investments due to high power costs, low renewable and battery costs, and the value of improving power resilience.

The option of using local power generation from a microgrid for supplying your electric power can alleviate the risk of power outages when your main grid fails. The utility that manages the main grid may be able to buy excess solar generation and may provide attractive power purchase options if the microgrid has a battery that can provide ancillary services, like frequency regulation, peak shaving, voltage control, power factor control, black start, or demand response. The main utility may also benefit by buying non-carbon emitting power, which can help the utility meet portfolio requirements. According to Wood Mackenzie, the US microgrid market is expected to grow at a compound annual growth rate (CAGR) of 19% from 2022 to 2027. In contrast, the US utility grid is expected to grow at a CAGR of only 2% over the same period.

The cost of grid power has been increasing.

Over the past 5 years, the cost of power in the US increased about 26% to 15.8 cents per kW*hr, Germany 20% to 27.5 cents per kW*hr, and China about 13% to 8.5 cents per kW*hr (with Japan at 27.5 and India at 12.5 cents).

There are several reasons for the increased costs of power:

- The cost of fuel, such as natural gas and coal, has been rising in recent years. This is due to several factors, including the Ukrainian war, increasing demand for energy, and the limited availability of fossil fuels.

- The power grid in many countries is aging and needs to be updated to support more distributed power. This is leading to increased costs for maintenance and repairs.

- The demand for electricity is increasing as the world economies grow, putting a strain on the power grid and leading to higher prices.

- Government policies, such as carbon taxes and renewable portfolio standards, have affected the cost of electricity.

- Weather events, such as heat spells, hurricanes, wildfires, and floods can stress or damage the power grid and lead to higher prices.

The cost of PV power and grid batteries has been declining.

According to the Solar Energy Industries Association (SEIA), the average cost of a US commercial PV system has fallen by about 60% since 2017.

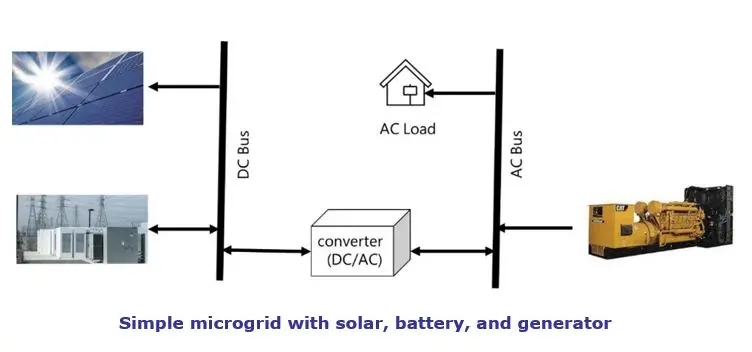

In a microgrid configuration, diesel power is usually too expensive to export to the grid, but excess PV power can often be sold to the grid, and with a microgrid battery that power may be fed into the grid when the grid needs it and is willing to pay a premium for it.

The cost of PV power has been dropping.

According to Wood Mackenzie, the US microgrid market is expected to grow at a compound annual growth rate (CAGR) of 19% from 2022 to 2027. In contrast, the US utility grid is expected to grow at a CAGR of only 2% over the same period.

According to the National Renewable Energy Laboratory (NREL), the average cost of a US grid-scale battery has fallen by about 75% since 2017.

The declining cost of lithium batteries can be attributed to the EV industry which created the supply chain and manufacturing scale need to reduce mining and manufacturing costs. In 2022, lithium nickel manganese cobalt oxide (NMC) remained the dominant battery chemistry with a market share of 60%, followed by the lower cost lithium iron phosphate (LFP) with a share of just under 30%. In recent years, alternatives to Li-ion batteries have been emerging, notably sodium-ion (Na-ion). This battery chemistry has the dual advantage of relying on lower cost materials than Li-ion, leading to cheaper batteries, and of completely avoiding the need for critical minerals. The Na-ion battery developed by China’s CATL is estimated to cost 30% less than an LFP battery. Battery costs will continue to decline, improving the economic case for microgrids. A sufficiently large lithium battery in a microgrid can shift power to the peak evening load for export or may be able to last through the night to service a local load during longer power failures. The solar battery combination can greatly reduce the need for generator operation and reduce fuel costs.

The economic toll of power failures has increased in Industry, commercial and especially residential sectors.

According to a study by the Ponemon Institute, the average cost of a power failure to an industrial customer in the US was $1.9 million in 2022, up from $1.2 million in 2017. In the US the average cost of a power failure to a commercial customer was $500,000 in 2022, up from $300,000 in 2017. And the average cost of a power failure to a residential customer was $10,000 in 2022, up from $5,000 in 2017. The ability to provide local power cheaper than grid power and avoid the cost of power failures is why the US leads microgrid growth, followed by Europe and Asia.

Large utilities can act as brokers as they understand the issues of connecting and managing microgrids. In some cases, large utilities may also own or operate microgrids themselves but microgrids owners are growing fastest at universities, military sites, healthcare facilities, commercial building complexes, power coops, municipal power companies, rural communities, and locations subject to power outages from weather events. There are a growing number of companies that are providing Energy as a Service (EaaS) where they will finance, design, build, own, and operate the microgrid. Utilities have always provided Energy as a Service, but now customers have the option of a local microgrid and even residential customers have found PV systems with batteries, (nanogrids) attractive. ARC will be publishing an update to their market study on “Microgrid Automation” in Q3 this year.