At Oracle OpenWorld last October, Kevin Kroymann, Director of Trade at Hormel Foods Corporation, gave a presentation about the company’s journey to improve the returns it gets from promotions with leading grocery retailers.

Based in Austin, Minnesota, Hormel Foods Corporation is a multinational manufacturer and marketer of high-quality, brand-name food and meat products for consumers. The company offers a wide variety of products, including hams, bacon, sausages, franks, canned luncheon meats, and shelf-stable microwaveable entrees and salsas. Hormel has 31 brands that are number one in their category. The company achieved sales of over $7 billion in 2010.

Hormel’s journey to improve its returns on promotions began back in 2004 when the company’s CEO challenged the sales and marketing group to grow sales at a faster rate than their budget for trade promotions.

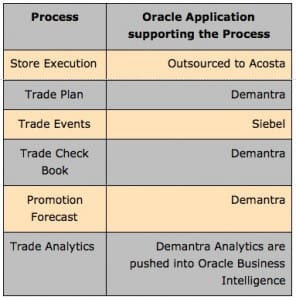

Hormel started by implementing Siebel in 2005, a leading Customer Relationship Management (CRM) solution that included a trade promotion management application. Oracle acquired Siebel that same year. Around that time, Hormel also considered implementing Demantra (a best-of-breed demand management supplier) for trade optimization, but the company concluded that the software vendor was too small at the time to do business with.

Hormel’s experience with Siebel was that while the solution allows you to capture trade transactions and begin the process of better executing trade promotions, these capabilities can only take you so far. The company needed forward-looking analytics that could help it project the ROI of trade promotions before they occurred. Win/win, high-ROI promotions are the ones Hormel wants to pitch to the large grocery chains.

In 2006, Oracle acquired Demantra. This acquisition gave Hormel the confidence to go forward with implementing Demantra for trade optimization in 2009. Hormel was the first company to implement an integrated solution that included Demantra and Siebel to help enable an end-to-end trade management/optimization process.

Hormel has achieved a number of benefits from implementing Demantra:

Hormel has achieved a number of benefits from implementing Demantra:

- Before the implementation, Hormel’s 60-day trade promotion forecast accuracy was 18 percent; today, it is greater than 50 percent (Account/Period/Product Group Level).

- Prior to implementing Demantra, one third of Hormel’s promotions did not even cover the incremental spend associated with the promotion. For example, if the promotion cost $50,000, the company would not even garner $50,000 in extra sales. Further, half of its trade promotions generated no significant lift. The Demantra application allows Hormel to project much more accurately what a given promotion’s Gross Margin ROI is likely to be.

- Based on the forward-looking analytics, Hormel has been able to improve the ROI of its promotions. While Mr. Kroymann was not willing to say how great these improvements have been, he did say the Demantra application has allowed the company to save millions of dollars, based on conservative estimates.

- The cultural changes associated with effectively using Demantra have been difficult. Hormel has used the forward-looking analytics for 30 different promotions; 23 have been successful. Mr. Kroymann stated, “We are just getting started.” Based on this, the potential long-term savings are much greater than what the company has already achieved.

- There is evidence that the relationship between Hormel’s trade account executives and selected retail account buyers is improving. Where the Demantra math has proved itself, the buyers are asking Hormel to come back and pitch other opportunities. This can help Hormel cement itself as a category captain.

Trade promotion optimization is at an early maturity level across the consumer products industry. This is because baseline applications or services (e.g., trade promotion management and store execution) must be in place before trade optimization can become fully effective. Further, any application that changes the way the sales force operates will always require more executive support to overcome cultural hurdles than is typical for other applications/process areas of coverage.

Finally, it is probably true that trade promotion optimization will have provide greater returns for category captains than for smaller manufacturers. A trade account executive needs to show a retail buyer that the promotion will generate significantly more in new sales for the retailer than it will cannibalize in sales of other brands in that category. The category captain has access to the sales and historical demand generated by competing brands. Smaller manufacturers will often not have access to such data.

(Note: Oracle is an ARC client)