At the CSCMP Annual Conference a couple of weeks ago, I attended the best supply chain presentation I’ve been to in years. It was given by Ron Volpe, Customer VP – Supply Chain at Kraft Foods, and Jon Golovin, CEO of Retail Solutions Inc. Kraft is using solutions from Retail Solutions to better leverage its downstream data. The company has a truly audacious goal for inventory reductions based on using this data.

I’d like to share some comments made by Jon about the maturation of shelf-level collaboration, with some supporting examples based on Kraft Foods’ experiences.

A few years ago, not all retailers were willing to share downstream data. Some actually charged manufacturers for it! Today, according to Jon, every major retailer in North America, except for Publix, is willing to share downstream data, or is at least piloting the value of sharing it. Nevertheless, the quality of the data, and the amount of data categories shared, is usually not at the same level as the data provided by Target and Walmart.

Jon described the maturity phases we have gone through to better leverage demand signal data. In the first generation, Walmart and Target built massive data warehouses that contained data about a manufacturer’s sales by store and SKU, as well as their inventory (at the SKU level) at both the retail store and warehouse levels, and other sets of data that allowed consumer packaged goods (CPG) companies to see what their sell through was.

The retailers gave the data for free, but it was up to the manufacturers to figure out the use cases. Kraft, for example, leveraged this data to see distribution gaps and send more inventory to where it was needed. Some CPG companies were successful in using this data for certain use cases, many others were not. First generation processes were based on sharing data, not collaboration.

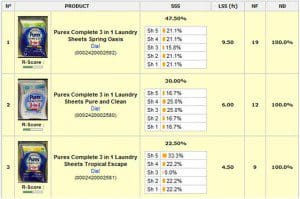

The second maturity phase involved retailer/manufacturer collaboration. The goal was to make the data actionable by joint processes called playbooks. Jon did not get specific here, but based on past research, I know that one playbook example involves detecting out-of-stock situations around a particular promotion at the store level. It is not enough to detect that a store shelf does not have inventory on it; a root cause analysis followed by actions by either the retailer (pull stock from the back room) or the manufacturer (reallocate inventory and increases the shipment size to a particular retail warehouse) may be needed to correct it. Jon spoke of the ability to develop as many as 50 playbooks.

In this second generation maturity phase, you don’t start with the data; you start with the use case. For example, if the goal is to make sure that a retailer does not buy too much inventory to support a promotion, you start by asking “What data do we need?” You would then work backwards to create analytics, alerts, and collaborative playbooks.

Jon also made the point that some retailers that were late to the game of sharing downstream data are now actually more advanced in collaboratively developing and acting upon these playbooks than the retail titans that invented the game. Delhaize was singled out, for example, as a retailer that would accept out-of-stock promotional alerts and whose merchandisers would actually act upon those alerts.

Third generation demand-driven companies seek to become more real-time enterprises by leveraging sell-through data to better make what people are actually buying. I’ve written this topic before (see Del Monte Foods and Shelf-Level Collaboration). Today, this is state of the art and it is the direction Kraft is headed toward.

Jon’s vision of fourth generation retail/CPG collaboration is retailers and manufacturers operating with one joint supply chain, instead of each operating their own. If a manufacturer and retailer each operate their own, then they each keep their own pools of safety stock. That really should not be necessary. Kraft also has a vision for how CPG manufacturers could better collaborate to serve a particular metropolitan market. Debbie Lentz of Kraft, who has been speaking of this vision for some time, has been elevated to the Senior Vice President level.

When I did a deep dive into shelf-level collaboration two years ago, I concluded that this would be one of the next big things that could allow our field to advance. However, I concluded most companies were probably years away from really being able to act upon this vision. That was why I was so excited by Ron and Jon’s presentation. Things have apparently moved far faster than I thought possible.