My cousin Lenny shared this photo on Facebook (the boys are not us, although the socks and shorts look familiar) with the following comment: “If u know about this game, u lived a great childhood.” The photo brought back so many great memories of my summers in Brooklyn — the concrete heat, the boombox music, the bloody scraped knees…and when it got hot, we grabbed the monkey wrench, opened the johnny pump, and took turns sitting on the gushing water. Yeah, cuz, we lived a great childhood.

My cousin Lenny shared this photo on Facebook (the boys are not us, although the socks and shorts look familiar) with the following comment: “If u know about this game, u lived a great childhood.” The photo brought back so many great memories of my summers in Brooklyn — the concrete heat, the boombox music, the bloody scraped knees…and when it got hot, we grabbed the monkey wrench, opened the johnny pump, and took turns sitting on the gushing water. Yeah, cuz, we lived a great childhood.

Now, this week’s news…

- LLamasoft Announces New Reference Rate Tariff Powered by SMC³ for Use in Strategic Supply Chain Design

- CargoSphere Tackles Carrier Contract Complexity and Wins with SUDS Technology

- Ryder Opens Two Natural Gas Fueling Stations in California

- Rockfarm Supply Chain Solutions Acquires RT&T Truckload Brokerage Division

- Freight Shipments Rose 1.2% in May from April

- Truckload and LTL Driver Turnover Rises in First Quarter of 2013

- U.S. Oil Soars Above $106 to 15-Month High (Wall Street Journal)

On the technology front, LLamasoft announced a new reference rate tariff based on specifications provided by LLamasoft and created by SMC³. According to the press release:

The SMC³ LTL reference tariff will be accessed directly from LLamasoft Supply Chain Guru and Transportation Guru software and will provide the rate data necessary to help determine the cost and feasibility of new network structures and shipping locations. By incorporating reference rates into their models, LLamasoft customers will be able to better understand how LTL rates will impact their overall strategy, enabling more intelligently-designed supply chain and transportation networks.

Meanwhile, CargoSphere introduced SUDS (Smart Upload and Diagnostics Solution), “intelligent technology that reads external rate data directly from any carrier contract format and loads it into a rate system database.” Here are some details from the press release:

When a contract is uploaded, advanced algorithms and smart reasoning extracts and organizes rates from endless pages of rate agreement contract data. These cutting-edge diagnostic features determine which rates are new and should be added versus rates which are currently in effect and simply need to be updated with revised rate levels. Once added, rates are returned back to the user through an audit feature for verification purposes. SUDS learns contract details and validations as the contract is being processed. Contracts only need to be mapped once and then that information is automatically applied to any subsequent amendments and updates.

As I highlighted a couple of months ago in “The Tipping Point for Natural Gas Long-Haul Trucks,” one of the key constraints in using natural gas trucks for long-haul shipments is the lack of filling stations. But progress continues to be made in this area. Shell and Travel Centers of America announced on April 15th an agreement to develop a nationwide network of liquefied natural gas fueling centers for heavy-duty road transport customers. And this week, Ryder announced that it has opened the first natural gas fueling stations in its North American network (at two of its maintenance and fueling facilities in Orange, California and Fontana, California) to serve both the general public and Ryder lease and rental customers. According to the press release:

The two facilities are part of a larger project which will displace more than 1.5 million gallons of diesel annually with 100 percent domestically produced low-carbon natural gas.

Each Ryder fueling location has three pumps – two Compressed Natural Gas (CNG) and one Liquefied Natural Gas (LNG)…LCNG stations rely on LNG delivered via tanker trailers. As a cryogenic liquid, and due to the extremely cold temperatures of liquefied natural gas, LNG is stored on-site in specially insulated cryogenic tanks. The liquid is then either dispensed as an on-highway fuel for LNG vehicles, or warmed, vaporized, and compressed for fueling of CNG vehicles.

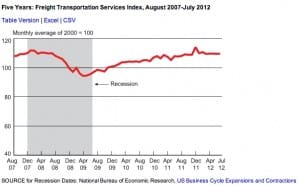

Finally, news from the Bureau of Transportation Statistics and the American Trucking Associations (ATA) raise some red flags about what could happen with trucking capacity and rates if the economy continues to improve. The Freight Transportation Services Index (TSI) rose 1.2 percent in May from April, “driven by growth in shipments by truck and rail accompanying broader signs of strength in the general economy.” The May level is the highest the index has been this year, “and is the second highest all-time level exceeded only by December 2011 and equal to the January 2005 level before the recession.”

Meanwhile, according to the ATA, “in the first quarter of 2013, the turnover rate at both large and small truckload carriers rose due to the improving economy and continued competition for well-trained professional drivers.” Here are some details from the press release:

According to ATA’s Trucking Activity Report, quarterly turnover at large truckload fleets – fleets with at least $30 million annual revenue – rose in the first quarter to an annualized rate of 97% from 90% in the fourth quarter of 2012. The rate was the highest it has been since the third quarter of 2012 when it was 104% and just below the average rate in 2012 of 98%.

“If the economy continues to improve as we expect it to,” [Chief Economist Bob Costello] said, “we’ll see competition for drivers intensify, which will increase not just the turnover rate and exacerbate the driver shortage, but will push costs for fleets higher as well.”

And with that, have a happy weekend!

Song of the Week: “Royals” by Lorde (“We crave a different kind of buzz”)

Note: LLamasoft and Ryder are Logistics Viewpoints sponsors.